Knowledge Base

Understanding Portfolio Metrics: Market Value, Cost Basis, Trade Value, PnL ans ROI

Understanding core concepts like market value, cost basis, trade value, and the difference between realized, unrealized profit and loss (PnL) as ROI is essential for interpreting your portfolio’s performance and managing tax obligations.

This guide explains these fundamental terms to help you interpret CryptoStash charts and understand your investments with confidence.

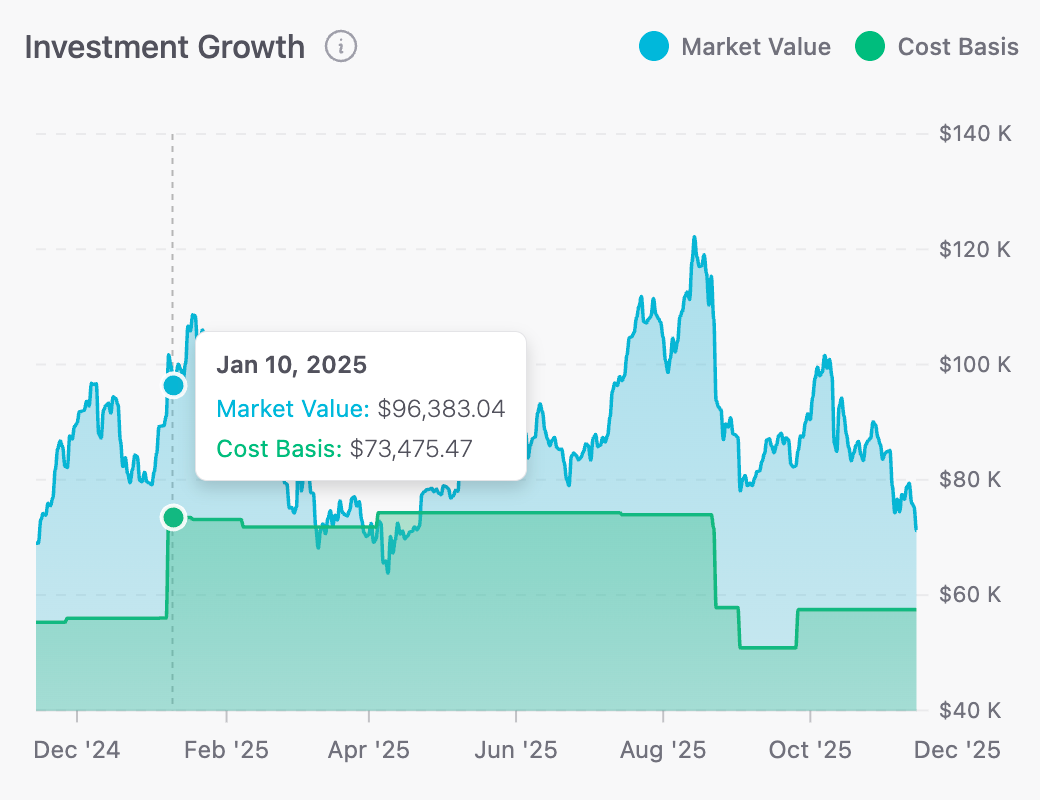

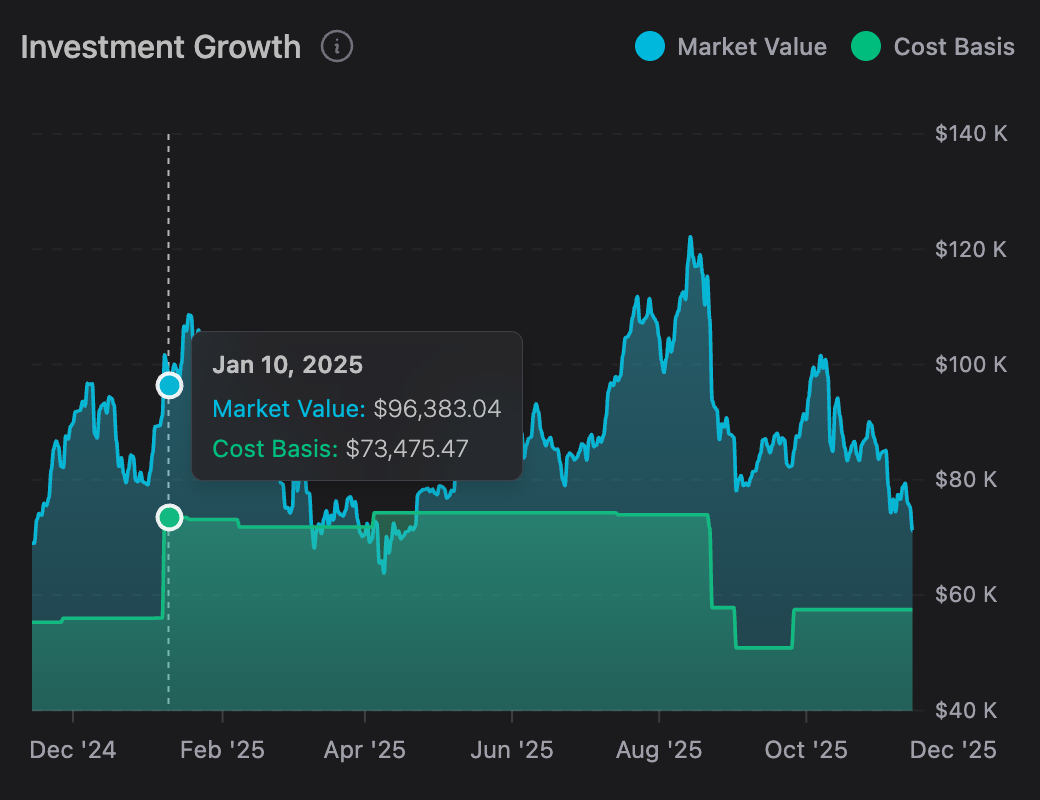

Market Value

- Definition:

- The total current value of all assets held in your portfolio, including assets acquired through both trades and transfers. It represents what your entire portfolio is worth at present market prices.

- Calculation:

- Market Value = Σ (Current Price × Quantity Held) for each asset in the portfolio.

- Significance:

- Market value reflects the real-time worth of your investments. As asset prices fluctuate, your portfolio’s market value changes accordingly. Monitoring it helps you understand your exposure, track performance, and make informed rebalancing or trading decisions.

Trade Value

- Definition:

- The total amount of money exchanged in a single trade (buy or sell) within your portfolio. It excludes asset transfers, as those do not involve a market transactions.

- Calculation:

-

Trade Value = Price per Unit × Quantity Traded

Buying 100 units at $50 each results in a trade value of $5,000. - Significance:

- Trade value quantifies the monetary size of your executed trades and is useful for tracking trading activity, costs, and liquidity.

Cost Basis

- Definition:

- The total amount you paid to acquire an asset, including transaction fees or other purchase-related costs. Cost basis is used to determine capital gains or losses for tax and performance calculations.

- Calculation:

- Cost Basis = (Trade Quantity × Purchase Price) + Fees

- Common Calculation Methods:

-

- Average Cost: Uses the average purchase price of all units to determine the cost basis.

- First-in, First-out (FIFO): The first units purchased are considered sold first.

- Last-in, First-out (LIFO): The most recently purchased units are considered sold first.

- Significance:

- Cost basis is crucial for accurately calculating capital gains or losses when assets are sold. It also affects performance metrics like ROI, helping you assess the profitability of your investments.

Unrealized PnL (Profit and Loss)

- Definition:

- Also known as paper gains or losses, unrealized PnL represents potential profit or loss on assets you still hold. These values fluctuate with market movements and are not realized until a sale occurs.

- Calculation:

-

Unrealized PnL = Current Market Value − Cost Basis

You bought a token for $100 and its current value is $120 — the unrealized profit is $20. If it drops to $90, the unrealized loss is −$10. - Significance:

- Unrealized PnL provides insight into the current performance of open positions. It helps identify potential profit-taking or loss-mitigation opportunities without triggering taxable events.

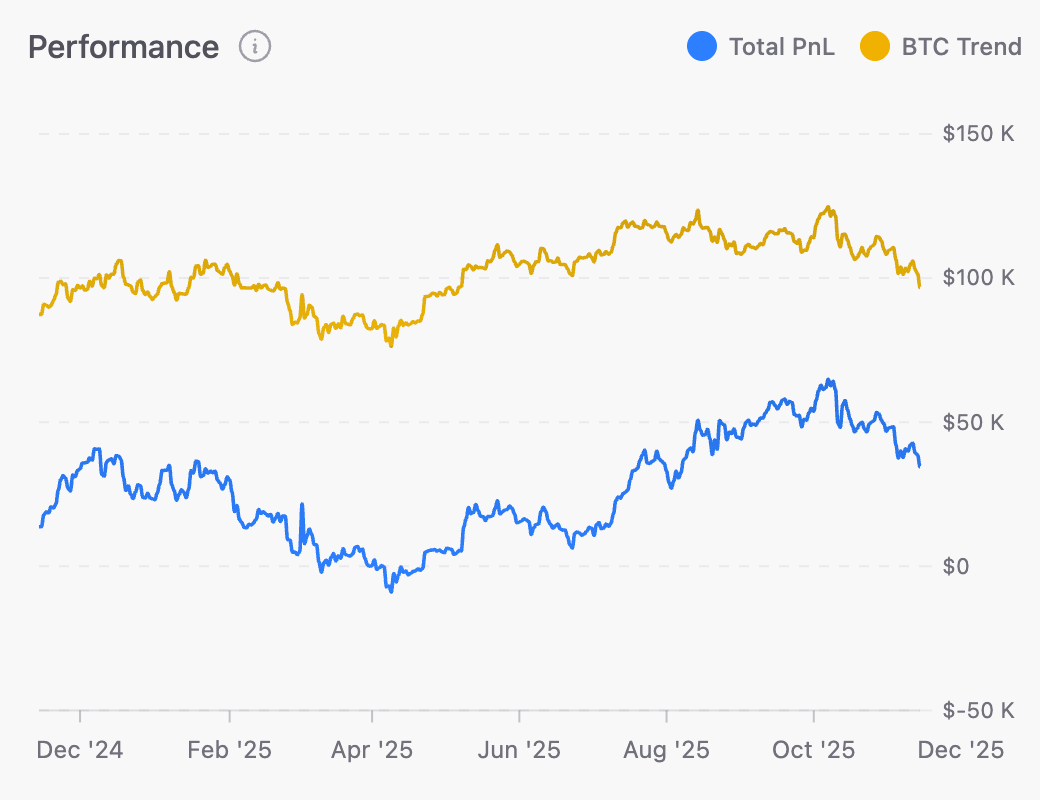

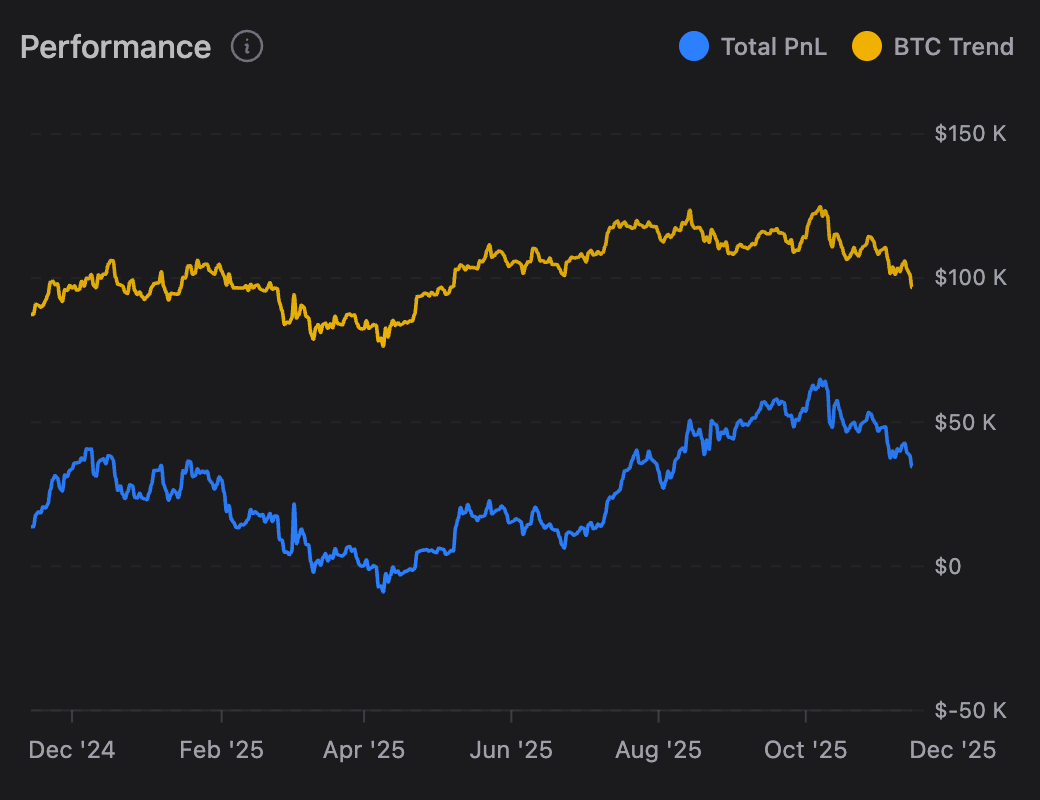

Realized PnL

- Definition:

- Realized PnL is the actual profit or loss from completed transactions — for example, when an asset is sold.

- Calculation:

-

Realized PnL = Total Sale Price − Total Cost Basis − Transaction Costs

You bought an asset for $100 and sold it for $150 — the realized PnL is $50 (before fees). - Significance:

- Realized PnL determines your taxable gains or losses and reflects the performance of completed trades, offering a clear measure of actual returns achieved.

ROI (Return on Investment)

- Definition:

- ROI measures the overall profitability of an investment relative to its cost. It shows how effectively your invested capital is generating returns, including both realized (closed) and unrealized (open) gains or losses. ROI can be calculated for a single position (asset-level) or for the entire portfolio.

- Calculation:

-

ROI = ((Realized PnL + Unrealized PnL) / Cost Basis) × 100

If your total cost basis for an asset is $10,000 and your combined realized and unrealized gains amount to $2,000: ROI = (2,000 / 10,000) × 100 = 20%.Alternative (Long-Term) Calculation:

For evaluating total portfolio performance over time — especially when capital contributions or withdrawals occur — ROI can also be based on total invested capital instead of cost basis: ROI = ((Current Portfolio Value − Total Invested) / Total Invested) × 100 - Significance:

-

ROI is one of the most intuitive indicators of investment

performance.

- Position ROI (Asset Performance): Measures the profitability of a specific holding based on its current cost basis. It's ideal for tracking ongoing trades or evaluating individual assets.

- Portfolio ROI (Overall Performance): Reflects the return of the entire portfolio relative to total invested capital. This broader measure helps you assess how efficiently your portfolio is growing as a whole over time.